The Ruawai Property Scam; The Lead Up – Blomfield’s attempted scam on Mangawhai Developments Limited.

In legal circles there’s a small quote that came from a rather large case that’s often used for determining whether or not something is to be considered a sham. It’s often referred to as the ‘Sham test’; a test which is now commonly applied when the need arises to establish if a transaction was, or is actually, a sham. The test was originally set out in Snook v. London and West Riding Investment Ltd (1967) 2 QB 786, when Justice Lord Diplock identified the elements in a sham transaction. To quote Diplock LJ:

“acts done or documents executed by the parties to the ‘sham’ which are intended by them to give to third parties or to the court the appearance of creating between the parties legal rights and obligations different from the actual rights and obligations (if any) which the parties intend to create…for acts or documents to be a sham, with whatever legal consequences follow from this, all the parties thereto must have a common intention that the acts or documents are not to create the legal rights and obligations which they give the appearance of creating. No unexpressed intentions of a ‘shammer’ affect the rights of a party whom he deceived”.

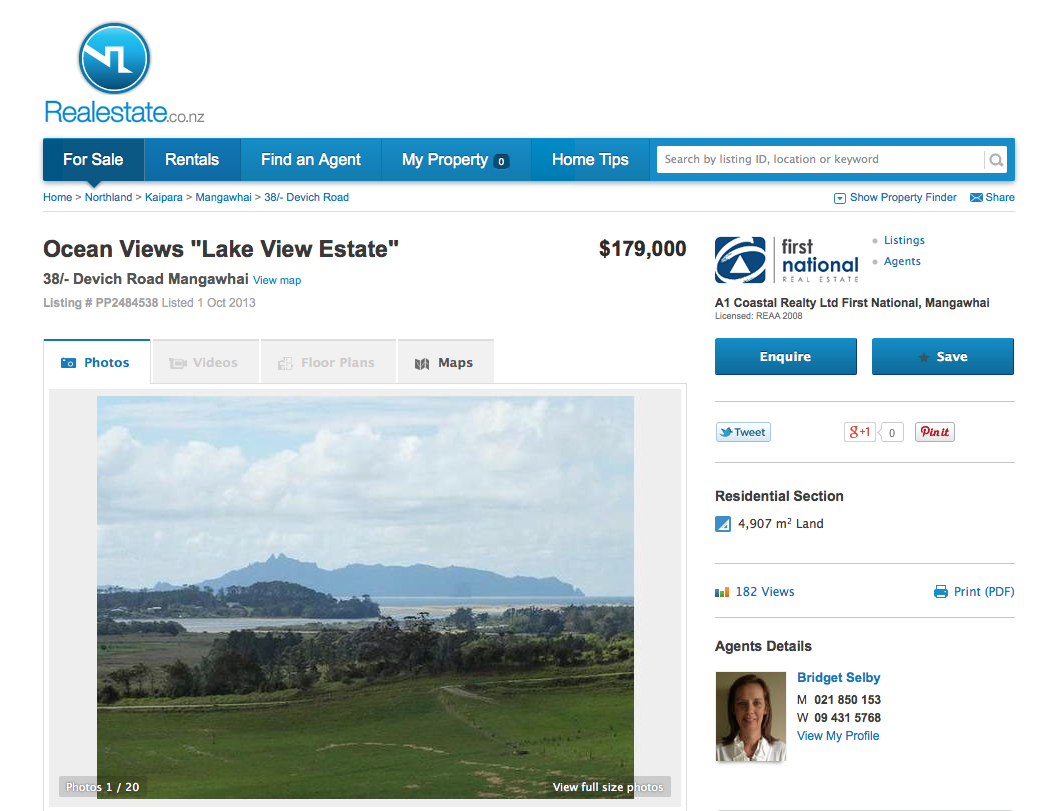

Now with this in mind, lets take close look at another chapter in the Matthew Blomfield saga, this time in and around a scam involving worthless contracts for sale and purchase that Blomfeild used for pecuniary gain between 2005 and 2007. Blomfield perpetrated this fraud on a company, its shareholders, and their banker, all of whom had invested heavily in the development of a rural subdivision known as Lake View Estate.

Lake View Estate, A current listing

This particular post looks at Blomfield’s dealings with a company called Mangawhai Developments Limited. Its a side of the story that has not yet been told; of how Blomfield scammed the company, its investors, and the bankers, who had advanced considerable funding on the 47 lots in stage one of the development, undoubtedly on the basis of sale and purchase contracts as their security. Somewhat conveniently an uncontested background to Blomfield’s fraud is to be found in sworn evidence in court judgments handed down by a number of High Court, and Court of Appeal, Judges. Keeping it simple we will use just one, the judgment of High Court Justice Tim Brewer:

Factual background

[5] The plaintiff (now in receivership) was the developer of a 47 lot subdivision at Devich Road, Mangawhai, known as ―Lake View Estate‖. In mid-2005 the plaintiff had not completed the subdivision (indeed it had only recently commenced the subdivision process) but had begun to ―pre-sell lots in it. It authorised a local real estate agent and an independent contractor, Matthew Blomfield, to market the lots. It is common ground that Mr Blomfield acted as a sales agent for the plaintiff at the material times.

Blomfield was aware of the state of play from the very inception of his deal with Mark Robinson to enter into a contract for sale and purchase with Mangawhai Developments Limited. Robinson on the other hand had simply placed his trust in Blomfield, and fully expected Blomfield to return the monies he had advanced Blomfield to be used as a deposit on each of the contracts. In reality, taking into account the available evidence, in 2005 when providing Blomfield with $50’000.00 for five $10’000.00 deposits, Robinson had absolutely no idea of what had, and was to occur, behind the scenes, and wouldn’t find out until he returned to New Zealand to attend court proceedings brought by Mangawhai Developments Limited in August 2010. At this time the “duped” Mark Robinson was undoubtedly left with little option but to stick to Blomfield’s plan, if Robinson was to have any chance of seeing his $50’000.00 returned. Much the same applied to Blomfields so-called second buyer, Ms Paki.

Blomfield knew, without a shadow of a doubt, at the time of signing the contracts in 2005 that the pair, Robinson and Paki, were not, and never would be, in a position to settle on the contracts for sale and purchase with Mangawhai Developments. Yet Blomfield, in deciding to defraud his school friend Mark Robinson, and the trusting Ms Paki, still invoiced Mangawhai for the $5000.00 commission on each of the sales. In defrauding Managwhai, his employer, given his clear conflict of interest, criminal Blomfield continued to take a $10’000.00 monthly retainer from Mangawhai.

Simply put, whilst neither Robinson or Paki had ever been in a position to settle, each had been assured by Blomfield prior to signing the contracts, they would never be required to settle, as Blomfield would on-sell the properties at a substantial profit.

Matthew John Bromfield is not the only cocksmoker in this sorry little tale of blatant media corruption and manipulation.

In August 2007 Blomfield was aware that his scam had unravelled. By August 2007 institutional lenders were struggling and funding was beginning to dry up. By December 2007 the global monetary system and property markets were in disarray, some argue close to collapse; and New Zealand’s luxury top end property market was certainly no exception.

Blomfield, having had his glorious epiphany, must have also realised that he was about to be drowning in an ocean of litigation demanding specific performance, unless he came up with another scam to extricate himself.

Blomfield was under a great deal pressure, not only because of the looming settlement dates, but from both Paki and Robinson, who by now wanted their deposit money returned as Blomfield had promised. Mark Robinson, in particular, was heavily exposed as a result of Blomfields extraordinary actions. It also appears that Robinson may have been having unrelated difficulties in the United Kingdom, where he had been living and working, playing professional football, since 2003. Reading between the lines in his emails to Blomfield, one is drawn to conclude that Robinson has borrowed heavily to fund the $50’000.00 he gave Blomfield on the assurance that it would be repaid quickly.

Evidence of Robinson’s predicament, and that Robinson was not involved in the planning and execution of the sham, is found in an email thread (three emails), respectively dated 25th October 2007, 5th December 2007, and 11th February 2008, between Mark Robinson and Matthew Blomfield, and a letter dated 13th January 2009 from Robinson’s Barrister, Mr Glenn Satherley.

Blomfield, LF believes prima facie, had attempted to raise the remaining capital required to settle on the properties as far back as August 2005 using Craig Roll’s Hamilton based mortgage company Basecorp Limited. The truth be told, the first meeting with Rolls scheduled to discuss a mortgage application that had probably been the reason why Roll’s had, in the first place, been introduced to Matthew Blomfield, and the Mangawhai Developments subdivision.

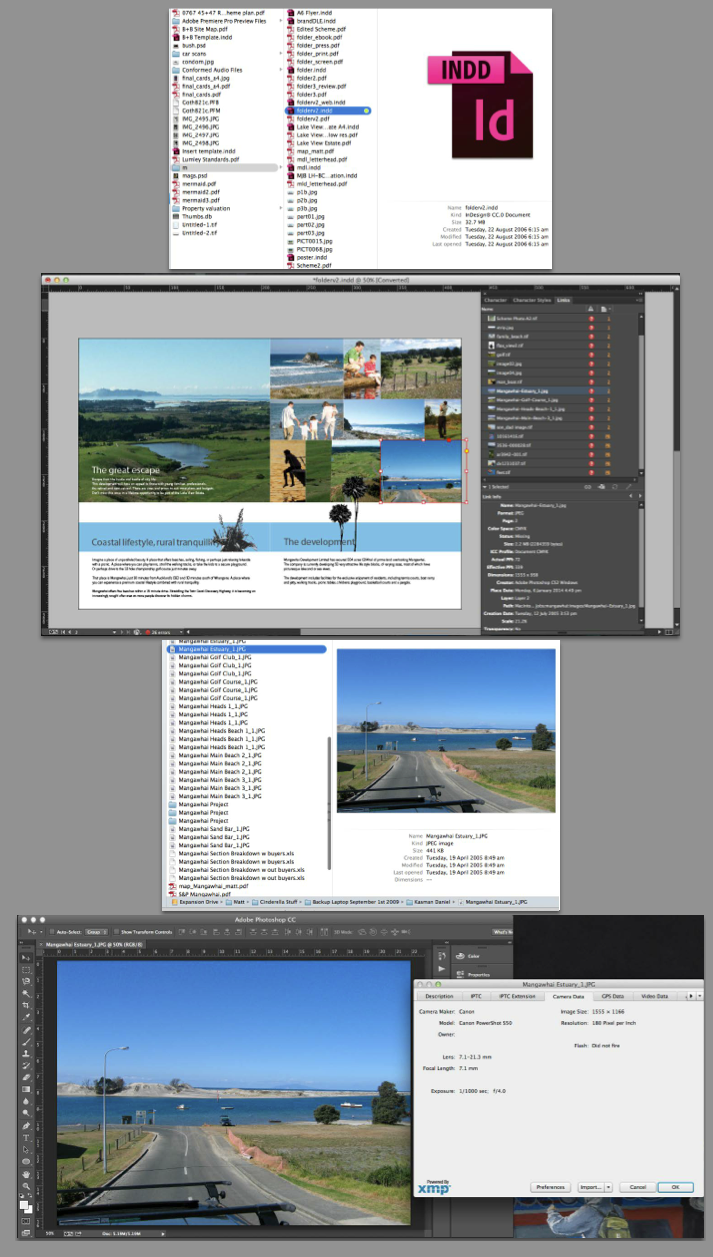

Regulars readers will recall that, subsequent to that meeting, Blomfield signed Rolls up on a contract to purchase Lot 14 in the same development on the 25th October 2005. Rolls, unlike the other buyers, had managed to scrape out of his contract by claiming that he had never seen the property in question, and that when he did, he only then realised it did not have the sea views Blomfield had promised. However Rolls was sued by the developers. Blomfield, during that 2011 hearing, before Justice Randerson, had also falsely claimed on oath, that he too, had never seen the sections in question, despite being responsible for designing the marketing material which included the sea views. Given Rolls profession as a mortgage broker, the evidence of Rolls and Blomfield is perjury, rather than a highly implausible scenario. Justice Randerson can’t be blamed for missing the deceit; after all perjury is designed to mislead.

In LF’s view, based on the material and evidence we have seen, we believe that both Blomfield and Roll’s deliberately misled Randerson J in 2011; so as to allow Rolls evade his contractual obligation to Mangawhai Developments Limited.

As we briefly pointed out in one of our previous posts, the Court somewhat foolishly never sought to address the issue of who it was that had actually been responsible for taking the photographs that appeared in the brochure. Those photographs were taken by Mathew Blomfield and Craig Rolls knew it.

It was undoubtedly Blomfield who took the photographs during one of his visits to the site in 2005; evidence of this was found on the hard drive LF obtained late last year that proves this. Evidence is in the form of decidedly amateur raw images/photographs, and a preliminary graphic layout of the brochure produced by Matthew Blomfield. Blomfield’s evidence before the Court that he had never physically sighted the development or lot 14, was complete and utter fabrication:

It should be noted that during the hearing of Mangawhai Developments Ltd (in rec) v Rolls HC Auckland CIV-2009-404-4253 [2011] NZHC 1503 (10 November 2011), Craig Rolls and Matthew Blomfield, in addition to giving sworn evidence that they never set foot on the Mangawhai site until December 2007, further downplayed their relationship, and cleverly avoided placing on record the exact nature of Rolls occupation; that of mortgage broker and lender, and the exact nature of the financial advice Rolls had given Blomfield on the day in question, back in August 2005; arguably preferring the ambiguous term “financial advisor” so as to throw High Court Justice Tim Brewer off the scent of their scam.

Factual background

[5] The plaintiff (now in receivership) was the developer of a 47 lot subdivision at Devich Road, Mangawhai, known as ―Lake View Estate‖. In mid-2005 the plaintiff had not completed the subdivision (indeed it had only recently commenced the subdivision process) but had begun to ―pre-sell lots in it. It authorised a local real estate agent and an independent contractor, Matthew Blomfield, to market the lots. It is common ground that Mr Blomfield acted as a sales agent for the plaintiff at the material times.

1 Mana Property Trustee Ltd v James Developments Ltd [2010] NZSC 90, [2010] 3 NZLR 805 at [22].

2 John Burrows, Jeremy Finn and Stephen Todd Law of Contract in New Zealand (3rd ed, LexisNexis NZ Ltd, Wellington, 2007) at [18.2.2].

[6] In August 2005 Mr Blomfield visited the defendant at the defendant’s office in Hamilton. The visit was in relation to the defendant’s occupation as a finance advisor, but in the course of the visit Mr Blomfield told him about the Lake View Estate subdivision. Mr Blomfield, in his evidence, said that he himself was excited about the subdivision, believing that there was money to be made, and it is evident that he passed on that excitement to the defendant. The defendant’s evidence, corroborated by Mr Blomfield and not contradicted by other evidence, is that Mr Blomfield told the defendant that the subdivision was to be a high quality lifestyle subdivision of larger sized sections with clear sea views, expansive lake views and in close proximity to the town and beach at Mangawhai‖. The defendant expressed himself to be interested in acquiring one of the sections.

[7] On 30 August 2005 Mr Blomfield emailed to the defendant a list of some of the sections for sale with their asking prices. Attached to the email was a sales brochure for the Lake View Estate subdivision which had been prepared by Mr Blomfield and approved by the plaintiff.

[8] The sections listed in the email were sections which Mr Blomfield had secured for himself as being attractive sections. He had a good relationship with the defendant (although not a social relationship) and wanted to focus him on a good quality section. As part of the brochure there was an aerial photograph of the subdivision with the proposed subdivision plan overlaid on it. I am satisfied that the defendant and Mr Blomfield discussed by telephone which of the sections might best suit the defendant before they settled on lot 14. The asking price was $275,000 and Mr Blomfield felt able to advise the defendant that this could be reduced by $20,000 for an early purchase. I am satisfied that the telephone discussion or discussions would have included the amenities of the subdivision and the views available from lot 14.

[9] Significantly, I find that Mr Blomfield made known to the defendant that Mr Blomfield had NOT seen the subdivision either.

[10] The defendant agreed to purchase lot 14 for $255,000. The agreement for sale and purchase was prepared and, eventually, signed on 21 October 2005. A payment of a $10,000 deposit was made. The defendant did not view the subdivision before signing the agreement.

[11] The completion of the subdivision, as anticipated, took some time. Before it was completed, in February 2007, the defendant finally went out and viewed lot 14. He gave evidence that he was shocked by the lack of views and the distance of the subdivision from the sea and from Mangawhai. He instructed his solicitors to cancel the agreement. The plaintiff did not accept the cancellation and proceeded on the basis that the contract was binding. The subdivision was completed and certificates of title were issued on 29 October 2007. On 6 December 2007 the defendant was informed that a certificate of title had issued for lot 14 and settlement was set for 13 December 2007 in accordance with the relevant provisions of the agreement for sale and purchase. The defendant maintained his position that the agreement had been cancelled lawfully in February 2007.

What representations were made by Mr Blomfield on behalf of the plaintiff?

[12] I find that the representations described in para [6] — that lot 14 had clear sea views, expansive lake views and was close to the town and beach — were representations made by Mr Blomfield as sales agent of the plaintiff. I find that the contents of the brochure, prepared by Mr Blomfield as sales agent of the plaintiff and authorised by the plaintiff for use in marketing the subdivision, are also representations on behalf of the plaintiff.

Were the representations untrue?

[13] Both parties called evidence on this issue. I accept that from lot 14 one can, depending on the weather, catch a ― peep of the sea on the horizon. I find that that is not the same as the property having clear sea views.

[14] The property does have good views of the lake and I find that in context they can reasonably be described as expansive lake views.

[15] The property is some kilometres from the Mangawhai village and Mangawhai Heads beach. It would take perhaps five minutes and 10 minutes respectively to drive there from lot 14.3 I accept the evidence that close is a relative term and depends upon context. Given that the brochure supplied to the defendant on 30 August 2005 clearly shows that this was a rural subdivision at some distance from the sea, I find that close in the context of this subdivision meant a drive of several minutes. The evidence is that the drive times are in the range of five minutes to 10 minutes. Accordingly, I find that this representation, in the round, was true.

[16] It was submitted by the defendant that I should not construe the representations separately. It is their overall effect to which I must refer. I agree with this submission. I find that overall the brochure plus the oral representations conveyed to the defendant that lot 14 was, while not coastal, nevertheless attractively situated so that a purchaser would enjoy good views of the sea and lake and be close enough to the town and beach to be able to drive to them without it being a journey. That overall picture was untrue. While being close enough to the town and beach for the trip to them not to be a journey, and while having good views of the lake, the distant view of the sea did not associate the lot with it. Lot 14 was part of a rural subdivision from which distant views of the sea could be achieved by some of the lots but not by lot 14. Lot 14 had, from part of it, a ―peep‖ of the sea depending on the weather.

In addition, it was more likely than not, that Blomfield had been dealing with Craig Rolls as a mortgage broker and lender, and not a “financial advisor” when attempting to cash in on the development, what other plausible explanation would Blomfield have had for providing details of the lots he, Paki and Robinson, had purchased in his email of the 30th August 2005 to Rolls (as detailed at para [8] of Brewer J’s judgement above). There is a great deal more evidence that inveigles Craig Rolls as a likely co-conspirator in Blomfields plans, and we will touch on some of that evidence a little later in this post, and the articles yet to come.

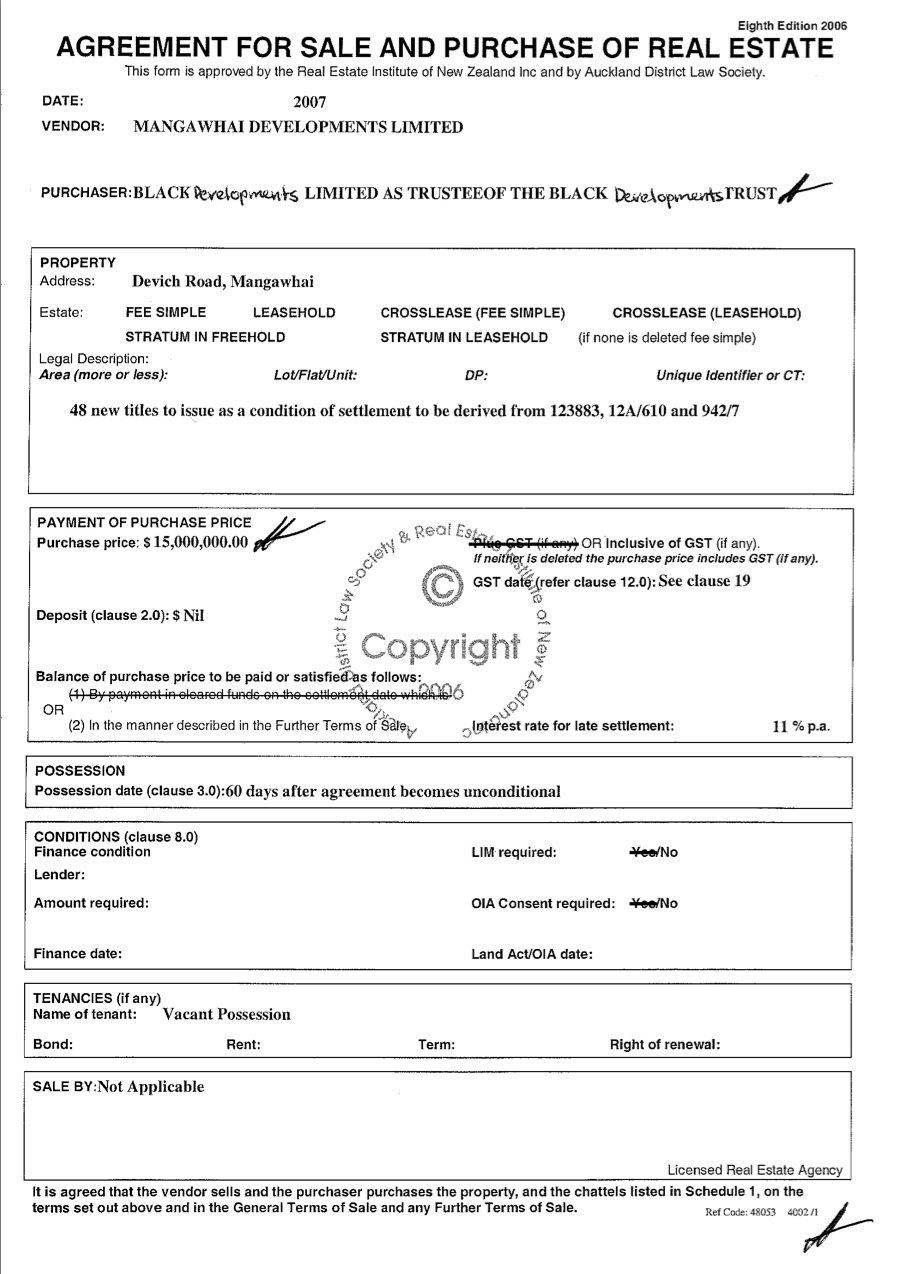

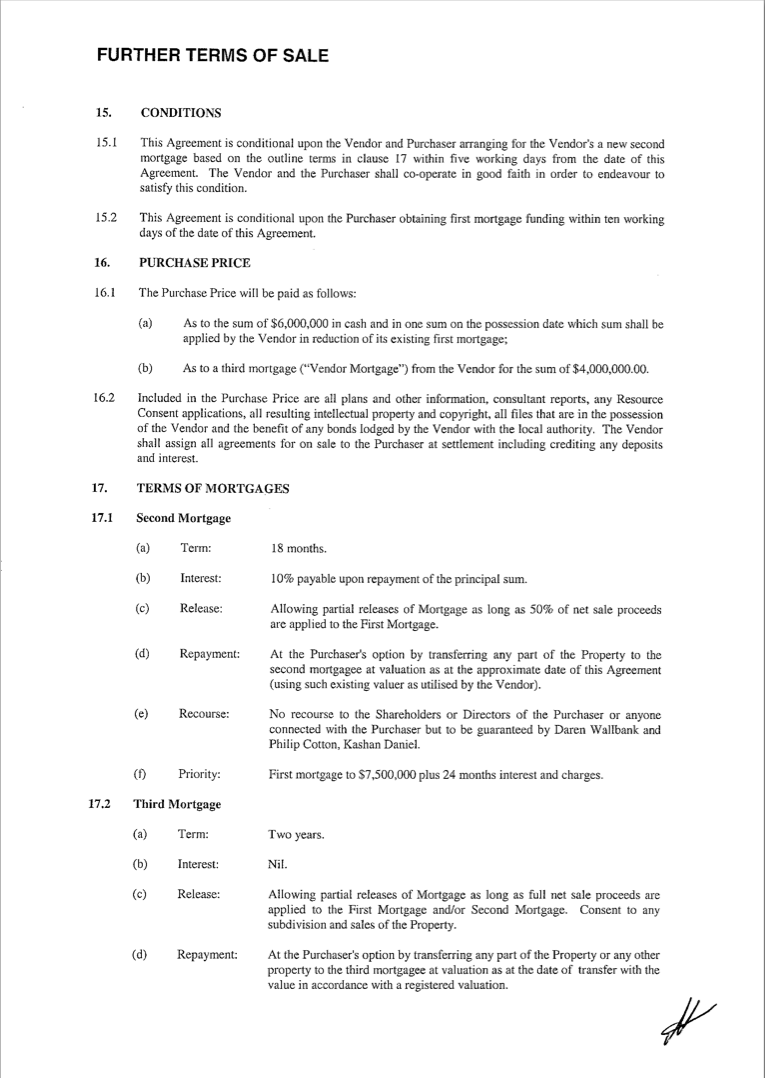

As aforesaid once Blomfield realised he wasn’t going to be able to settle on the 7 to 8 lots he had purchased via Robinson and Paki, Blomfield decided to come up with another “winner takes all” strategy. Blomfield moved unilaterally, without instructions from the purported owners, instructing his solicitor to cancel the contracts on the 28th September 2007, such contracts ostensibly held by both Robinson and Paki. The very same day Blomfield wrote to Mangawhai Developments Limited making an offer to purchase the entire 22.5 hectare, 47 Lot stage one subdivision and the as yet to be developed stage two, 125 hectare adjacent parcel of land.

Blomfield, an employee of Mangawhai Developments Limited, was clearly “in conflict”, being aware of the financial difficulties caused by his strategy in fraudulently cancelling the 8 contracts. Blomfiled and Rolls hoped that this would break the back of the entire development defrauding the stake-holders inclusive of his old school friend Mark Robinson.

Blomfields drought offer to Mangawhai developments Limited for sale and purchase of their development (Click to view full document)

Further terms of sale/conditions (click to enlarge) – Was Blomfield a heavy coke user? Check out clause 17.1 (e)

Blomfield’s and Rolls criminal scam didn’t work. The Directors of Managwhai refused to take the bait and Blomfields “fire-sale” offer of $15 million (with conditions) for the entire 125 hectares of which the 47 lots in stage one comprised just 22.5 hectares, leaving 102.5 hectares remaining to be subdivided and developed.

Blomfields outrageous disregard for his employers financial welfare and the arrogant contempt with which he thought he could manipulate a now financially strapped company for his own financial benefit raises a series of additional questions. The first of which is as obvious as balls on a short haired dog – remember readers, Matthew John Blomfield was broke, not a brass razoo to his name, so where on earth was he going to get a spare 15 million dollars in the middle of the GFC?

Blomfield’s financial position was never in question during the court proceedings Mangawhai Developments Limited brought against Mark Robinson et al; therefore it was not within the courts mandate to have cause to investigate Blomfield, or his financial position at the time. Justice Woodhouse, for some reason felt it important to ensure that the aforementioned outrageous behaviour of Blomfield be noted for the record. In his judgment, at para [34], Woodhouse J recalls;

[33] Work on the subdivision was slower than the plaintiff had anticipated. Mr Cotton and Mr Wallbank, for the plaintiff, said that there were a number of reasons for this, including delays by Infrastructure NZ Ltd and imposition of subdivision consents more onerous than had been anticipated. There was some evidence of a dispute between the plaintiff and Infrastructure NZ Ltd relating to outstanding payments owed to Infrastructure NZ Ltd. There were differences between the plaintiff’s witnesses and Mr Blomfield as to who was responsible. It is unnecessary to go into the detail of that dispute.

28 September 2007 : Mr Blomfield’s effort to acquire the plaintiff’s land and subdivision works : purported cancellation by MDJ Properties and Mr Robinson

[34] On 28 September 2007 Mr Blomfield sent a draft of an agreement for him to purchase the plaintiff ’s land. A draft offer was copied to the plaintiff, but there were also communications with the finance company which had provided the plaintiff with the facility for over $9 million and which, of course, had security over the plaintiff’s land. On the same day notices of purported cancellation of the agreements with MDJ Properties and Mr Robinson were issued by solicitors. I am satisfied that Mr Blomfield was responsible for the instructions to the solicitors to issue the notices of cancellation. I am also satisfied that this was done when there was no justification for doing it to seek to put pressure on the plaintiff, and on the finance company, to further Mr Blomfield’s efforts to acquire the plaintiff’s land.

[35] Mr Robinson said that he had no involvement in preparation of the two letters of purported cancellation. It is implicit in Mr Robinson’s evidence, which I accept, that the instructions to the solicitors on matters of detail – specific grounds for cancellation – came from Mr Blomfield. Each letter alleges breach of contract in seven identical respects. It is unnecessary to set out the detail. It is sufficient to note at this stage that I am satisfied that none of the grounds provided grounds for cancellation and some of the grounds were contrived to say the least. Some aspects of this are discussed later. It may also be noted that the notices of purported cancellation were issued just under 13 weeks before the sunset clause in clause 25 of the agreements and without any preceding settlement notice making time of the essence in respect of the alleged defaults.[2] The claimed right of cancellation was rejected on behalf of the plaintiff.

[63] Mr Mercer submitted, for all defendants, that the alleged obligation to complete all of the specified communal facilities prior to settlement was a condition to which the agreements were subject in the sense contemplated by the REINZ standard clause 8.7; that is to say, if the condition was not satisfied prior to settlement the purchasers were entitled to cancel pursuant to clause 8.7. The submission at this point was, therefore, that this contended for provision was what is conveniently referred to as a ―contingent condition‖.[5] Because I have concluded that it was not a term of the agreements that any particular facilities be completed prior to settlement, it necessarily follows that there was no contingent condition to this effect. It is nevertheless relevant to note that it appears that the contingent condition argument was advanced to support a submission that the purported cancellation of the agreements on behalf of Mr Robinson and MDJ Properties, by the letters on 28 September 2007, and long before the sunset date, were justified. The conclusion I have reached also means that the purported cancellation in those letters on the grounds of failure to have completed particular communal facilities some months before settlement was not justified. I am also satisfied that the other grounds recorded in those letters did not provide grounds for cancellation. There is no satisfactory evidential foundation for the allegations contained in the letters. Some of them border on the fanciful.

Justice Woodhouse was certainly backing the right horse when he found:

There is no satisfactory evidential foundation for the allegations contained in the letters. Some of them border on the fanciful.

Whilst LF would argue that the words ‘contrived‘ and ‘fanciful‘ are somewhat innocuous and fail to adequately describe Blomfield’s actions, they do go half way in describing Blomfield, his criminal machinations, and his court room antics.

LF reiterates, Matthew John Blomfield was all but broke at the time, and all he ostensibly had to his name was the commission, and retainer, paid to him by Mangawhai; thats if Blomfield had managed to save any of it, which is unlikely as readers will see Blomfield later borrowed an additional $15’000.00 to cover “unrelated expenses” (see para [65] Ruawai Properties Ltd v Black Developments Ltd), and that makes for a man hell bent on doing what ever it takes to get his own way.

Additionally, supporting the argument that Blomfield was alone, incapable of buying Mangawhai Developments land for $15 million, is the fact that Blomfield had to swindle Mark Robinson, and Ms Paki, for the deposits on the sections they’d purchased in late 2005.

Therefore if, for arguments sake, Mangawhai Developments had taken the bait and accepted Blomfields offer to purchase the entire development for $15 million (with conditions), then how the fuck was Blomfield going to pay for it?

LF suspects, for a number of very good reasons, this is where Craig Rolls and Base Corp Limited might just again been waiting in the wings. LF believes that the necessary funding had already been arranged. That funding was to be supplied by none other that mortgage financier Basecorp Limited; a loan facilitated by Craig Rolls.

The email from Craig Rolls to Matt Blomfield (above) is a clue to what it was that Blomfield and Rolls had been up to behind the scenes, almost exactly the same plan that was to again be used on another unsuspecting victim at around the same time.

Blomfields offer to buy the development from Mangawhai Developments, despite the criminal duress Blomfield had managed to inflict, had been rejected by financially savvy directors. LF believe’s that Blomfield, having cancelled the contracts he had control over, far from walking away, decided to, stupidly, up the anti.

Remember readers, Blomfield and his Lawyer, we suspect Bruce Johnson of Corban Revell, had sent separate, but identical, letters cancelling each of the contracts for sale and purchase to Mangawhai Developments Limited on the 28th September 2007. For most normal parties, had the complaints been genuine, thats where it should have been left, save perhaps in the event of Mangawhai issuing proceedings to uphold their rights under the respective contractual agreements (which they eventually did in 2011).

Blomfield, as has been the pattern over many years, did not walk away, in fact far from it. Blomfield did not even think to change his strategy. LF believes that Blomfield, again with his inside knowledge, as an employee/agent, was convinced that all he had to do was increase the duress on Mangawhai Developments. We believe that Craig Rolls was privy to Blomfield’s next move and, on the available evidence, had likely agreed to financially backing Blomfield in the hope that Blomfeild’s criminal strategy would succeed.

Having decided that, by increasing the financial pressure on Mangawhai Developments, and that company’s mortgagee that they would eventually prevail, Blomfield decided to attempt to incite, with financial incentives, a number of other buyers to also cancel their contracts, hoping that the land slide would force Mangawhai Development Limited, and their mortgagee, to accept the conspiritors offer. With this in mind Blomfield set about organising a clandestine meeting behind the backs of his former employer/principle, Mangawhai Developments Limited.

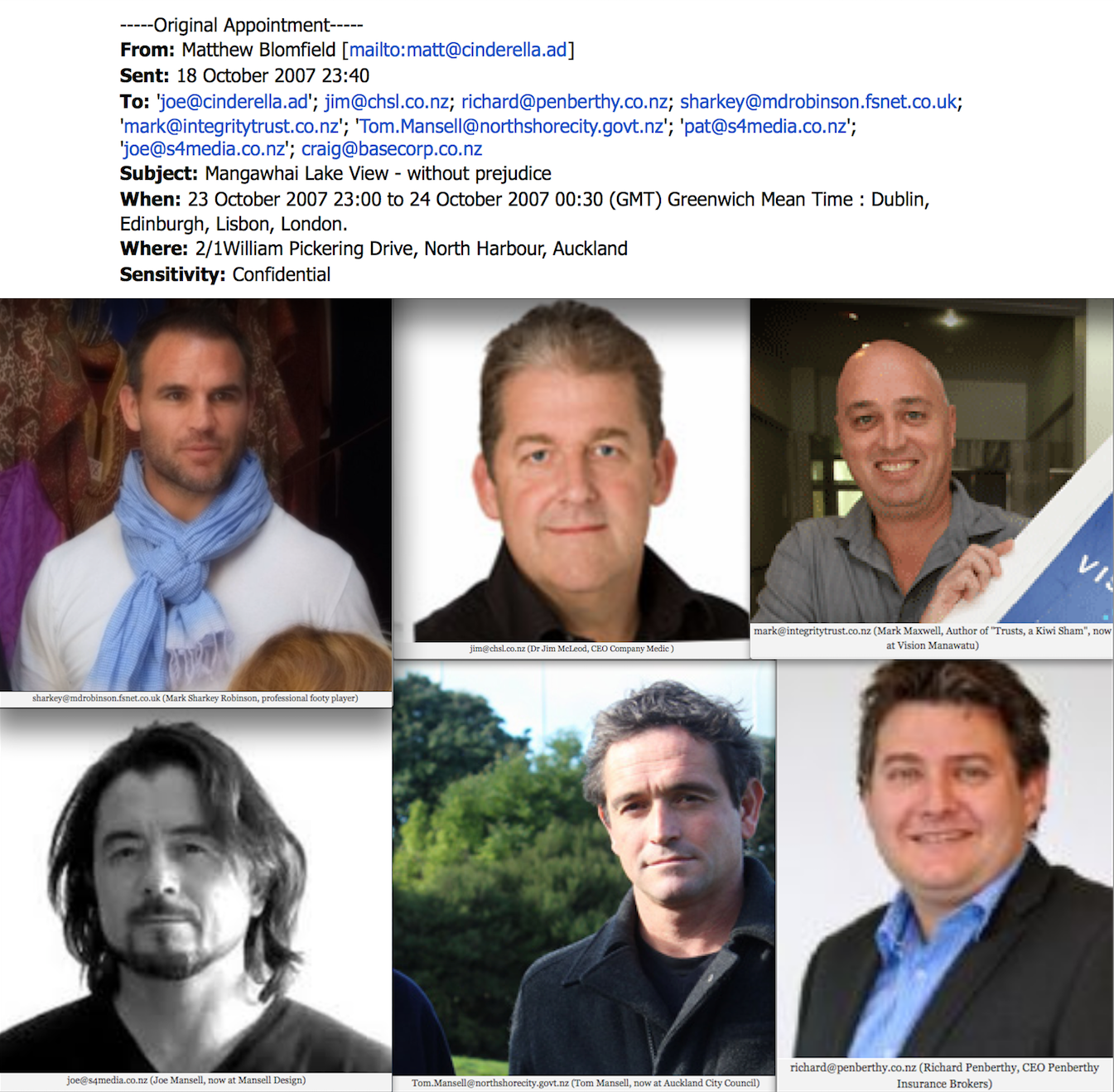

Blomfield was cautious. Blomfield invited only those he knew, or felt, he could trust or manipulate, to the meeting. The email that evidences this meeting is dated 18th October 2007. This less than a month after Blomfield had unilaterally cancelled the Robinson and Paki contracts with Mangawhai Developments.

Moreover, Blomfeild’s intentions are further disclosed in the body of the email, albeit in somewhat coded language; the deal that Blomfield was attempting to stitch together, was a conspiracy which Blomfeild euphemistically refers to as a “Common project”. Undoubtedly his plan came with an added lure of a financial benefit, if those who received Blomfield’s exclusive invite, were of a mind to go along with the plan to fuck over Mangawhai Development limited. Blomfield no doubt also discussed the Ruawai Properties scam, which was about to bear fruit, with a view to having them transfer their investment, in the event that Mangawhai Developments scam fell over. Craig Rolls had also agreed to back Blomfields attempt to swindle the Yelcich family (see below).

As with any other financial facility of this nature the company would have undoubtedly relied on these unconditional contracts to continue its progressive draw downs on the mortgage. Thus Blomfield sought to wrest control of the subdivision at a fire sale price by damaging the financial assurance the contracts provided, and having the threat of foreclosure hanging over the company’s head. Blomfield also knew that the GFC had further ensured the real possibility of this type of predation:

—–Original Appointment—–

From: Matthew Blomfield [mailto:matt@cinderella.ad]

Sent: 18 October 2007 23:40

To: ‘joe@cinderella.ad’; jim@chsl.co.nz; richard@penberthy.co.nz; sharkey@mdrobinson.fsnet.co.uk; ‘mark@integritytrust.co.nz’; ‘Tom.Mansell@northshorecity.govt.nz’; ‘pat@s4media.co.nz’; ‘joe@s4media.co.nz’; craig@basecorp.co.nz

Subject: Mangawhai Lake View – without prejudice

When: 23 October 2007 23:00 to 24 October 2007 00:30 (GMT) Greenwich Mean Time : Dublin, Edinburgh, Lisbon, London.

Where: 2/1William Pickering Drive, North Harbour, Auckland

Sensitivity: ConfidentialHi all

I have received a number of calls relating to Mangawhai and a number of you have suggested we all come together to discuss what is and has happened. A meeting will be held at 2/1 William Pickering Drive Albany (Cinderella Office Level One signage on the building) at 11:00am on Wednesday the 24th of October. Topics to discuss will be as follows:

* Current state of titles

* Communal facilities

* Other Matters

It is encouraged that if you have any correspondence of information that you would like to share please bring it to the meeting to discuss. We are all in the same boat.

This email is sent without prejudice and is sent as a response to a number of people who have contacted me asking for a meeting. The intention of the meeting is for a group of people to get together and discuss a common project and my part is the offer of a location for the meeting. I will however be attending as a purchaser and will discuss any matters relating to the development and the contact we all signed. The meeting will be held without prejudice. I know I have missed some people off the list so feel free to forward this email on to other purchasers.

Look forward to seeing you all

Matthew Blomfield 021 362 462

Director MDJ Properties Limited

The information transmitted is intended only for the person(s) or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of this information by persons or entities other than the intended recipient is prohibited. If you received this in error, please contact the sender and delete the material from your computer.

Of course Blomfield hadn’t received any calls from any other buyers, this was just a ruse, as were many of the claims Blomfield made in the email, not the least of which was his last sentence:

“I know I have missed some people off the list so feel free to forward this email on to other purchasers”

Blomfield, having been an employee of Mangawhai Developments Limited, was the only person likely to be privy to the details of those who had purchased lots from the company, being the company’s sales agent Blomfield was the only one likely to have had access to the names and email addresses of those who had purchased lots. Blomfield knew full well that those on the exclusive list he had invited, via the above email, to his little soirée were incapable of contacting other buyers, which was of course his intention all along. Reading between the lines ‘Mums the word was obviously an idiom favoured by Blomfield.

The meeting took place as planned but the outcome was obviously not entirely favourable. Nevertheless it is clear that whilst invited, Craig Rolls thought it wise to remain at arms length and chose not to attend. Rolls did however email Blomfield immediately after the meeting, some what suspiciously Rolls email was brief and to the point:

Craig Rolls <craig@basecorp.co.nz>

To: matt@cinderella.ad

How’d the meeting go Mattster?

Craig Rolls

Lending Manager Basecorp Finance Limited Ph 07-839 2999

Fax 07-839 2992

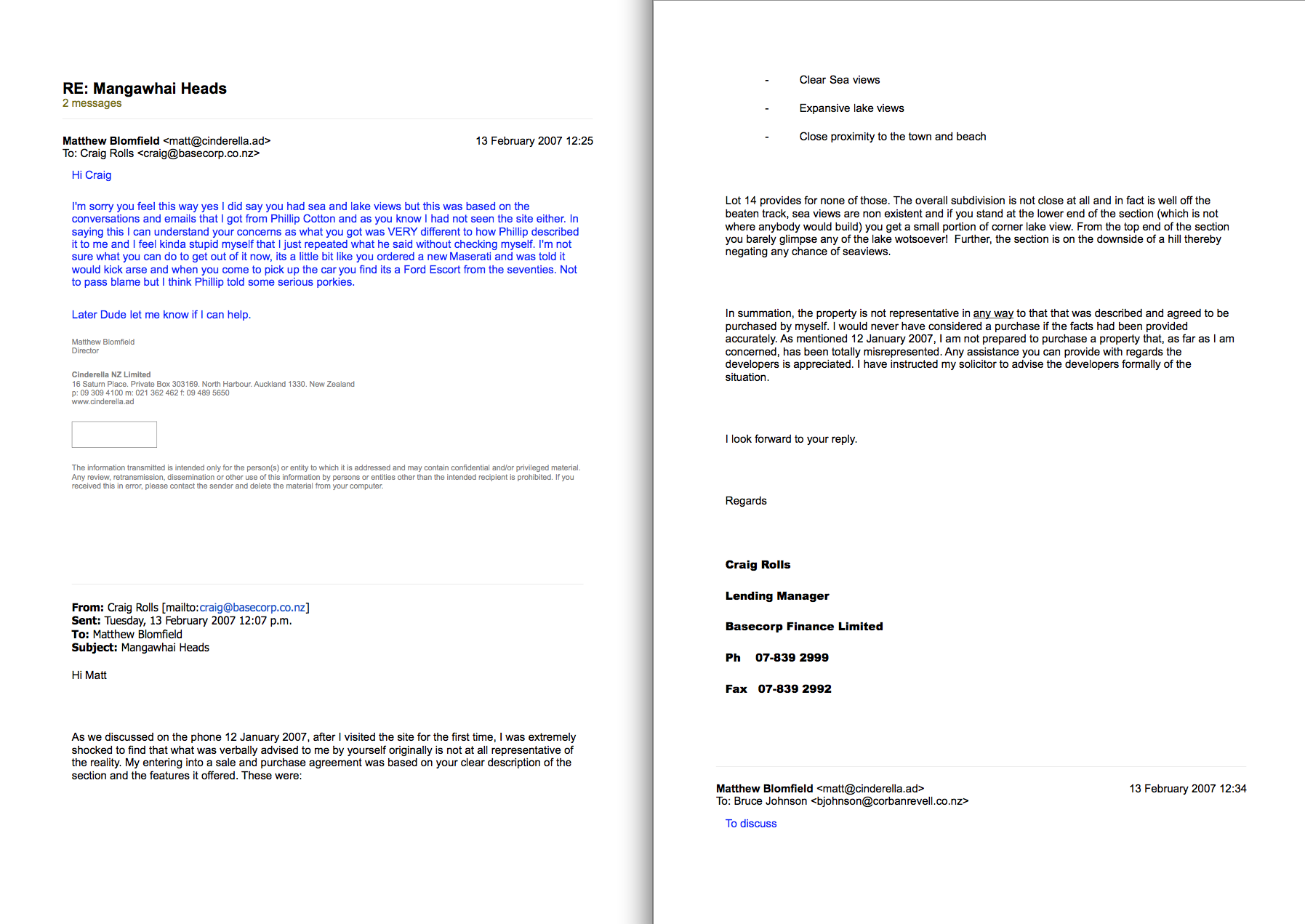

Craig Rolls email is suspicious on many levels. Remember, Craig Rolls is the same man, the simple “financial advisor” that testified on oath in the High Court at Auckland, before Justice Brewer, that he had purchased lot 14 on the 21st October 2005, and that he did not know Matthew Blomfield socially, and that he’d had nothing more to do with Mangawhai Developments until December 2007, when he eventually got around to inspecting lot 14; only to discover that it did not have lake or sea views as Blomfield, and the brochure that Blomfeild, had produced purported. As we know on this perjury of Blomfield and Rolls, Rolls successfully cancelled his contract so as to assist Blomfield in ripping off the other stakeholders.

Basecorp Finances lending manager Craig Rolls: Matthew Blomfield’s financial backer and corporate fuck-buddy!!

As if that was not enough evidence, somewhat coincidentally on the 6th December 2007, around the same time Rolls claimed he’d first physically inspected his Mangawhai Developments Lot, Rolls is found hiding behind the shrubbery, this time financing Blomfield in an almost identical property scam that saw Boris and Jean Yelcich robbed of their land in a conspiracy that, just like the unsuccessful Mangawhai Developments scam, Blomfield, Rolls and his cabal covertly approached the Yelcich’s Mortgagee and together conspiring to rob, for their own collective pecuniary gain, the Yelcichs of their property law rights, life-time investment and livelihood.

So to recap, Rolls a high flying mortgage broker and lender contracts to purchase Mangawhai Developments lot 14 on the 25th October 2005, Rolls purportedly, according to his sworn evidence, doesn’t inspect his expensive purchase for well over two years, again according to his evidence in December 2007, although Woodhouse J fails to specify and note the purported date. The part that the court did not get to hear about however was that Rolls, despite his claim of never having inspected Lot 14, is in constant communication with Blomfield, from September 2007, when Blomfield cancels The Robinson and Paki contracts, whilst trying to get his grubby little hands on Mangawhai Developments Limiteds land.

This is evidenced by an email (above) dated 18th October 2007, wherein Blomfield invites Rolls and others, that Blomfield thought he could either trust or control, to a meeting to discuss Mangawhai Developments, and what Blomfield euphemistically referred to as a “Common Project”. Then, according to the judgement of Randerson J, para [64] (see below) Rolls and his company Base Corp Limited enter into a mortgage agreement, on the 5th December 2007, with Blomfield over the land that Blomfield had swindled from Boris and Jean Yelcich and their company Ruawai Properties Limited. This is incredible, Rolls only then, one is to believe, coincidentally, for the first time, inspects Lot 14 of the Mangawhai Developments site.

LF knows that Rolls claims to have inspected the site in December 2007, whilst the court judgement fails to note a date, in December 2007 Lf can now advise, if one is to believe the email below, that Rolls purported site inspection is first noted in an email from Rolls to Blomfield two months after Rolls had paid out between $400’000.00 and $415’000.00 to Matthew Blomfield for the purchase of the Yelciches Ruawai Properties land:

In the above email, dated the 13th February 2007, Rolls purports to have first notified Blomfield of his concerns over Lot 14, during a telephone conversation the pair had, purportedly, on the 12th January 2007. Unlike Rolls court testimony there is no mention whosoever of December 2007.

LF is of the opinion that this email is a sham, a bogus construct. The chronology, the extraordinary delay between purported contact between the pair, Rolls bullshit arguments, the way email thread and Blomfield’s lazy relaxed response are structured, especially given the other unreported dealings between them, makes the emails stink to high heaven.

It’s a series of emails, that by design, were obviously set in place as part of an elaborate sham, designed to, if need be, fool a court of law, and assist Rolls in building the case he needed so as to escape his contract with Mangawhai Developments limited. Of course these emails were only ever meant to be viewed in isolation, in fact they had to be viewed in isolation to remain credible. Once viewed with the other evidence, details that the courts never got to see, the emails have, very much, the opposite effect of that which Roll’s and Blomfield had intended; it makes them both look like complete and utter fuckwits, and exposes them both as the criminal conspirators they are.

Rolls involvement in the scam that saw the Yelcich family ruined was only briefly touched on in the judgment of Randerson J in Ruawai Properties Ltd v Black Developments Ltd HC Auckland CIV 2008-404-001557 [2008] NZHC 837; (2008) 9 NZCPR 483 (5 June 2008), although Rolls name is not specifically mentioned by Randerson J, the Hamilton based mortgage company of which Rolls is a Director and lending manager most certainly is:

[64] A further factor is that on or shortly after the settlement of the purchase of the farm block, Black Developments (Blomfield) borrowed nearly $400,000 from a company named Basecorp Finance Limited. A mortgage was granted to Basecorp over the title and was registered on 5 December 2007, shortly after the purchase.

[65] I raised Basecorp’s position during the hearing and allowed Black Developments to file an affidavit after the hearing since Basecorp had not been served with the applications. Mr Blomfield has provided evidence that $415,000 remains outstanding under this mortgage, the funds being borrowed for unrelated trading purposes. Basecorp is said to be an unrelated “arm’s length” finance company. There is no evidence that its interest in the property was obtained other than in good faith and without notice of the claim for relief by Ruawai Properties.

[66] Finally, it does not appear that the first mortgagee has been served or given an opportunity to appear to present its position. Were this the only factor preventing the grant of relief, however, I would have directed the first mortgagee to be served.

So lets now go back to an earlier post where we featured Blomfield’s spin doctor apologist piece, which featured in the New Zealand Labour Party’s online rag, ‘The Standard’, and its founder Lynn Prentice’s bullshit intro:

When the wolf cries boy

WrittenBy: LPRENT – Date published:7:10 pm, December 6th, 2013 – 126 comments

Categories: blogs, news, spin – Tags: cameron slater, matthew blomfield, whaleoilMatthew Blomfield, the defamation plaintiff against Cameron Slater who has been exciting the journalistic and blogging communities this week asked to make a statement to clear up some issues that have arisen in the blog space.

There was a lot of stupidity and outright bullshit (like allegations that Mr Blomfield was an undischarged bankrupt) in the comments in an earlier post that put this site at a legal risk (including comments from Cameron Slater). So I agreed to do it only if the post was fully moderated. Rational discussion without unsupported assertions of fact will be let through where they do not impede the case currently in front of the courts.

Mr Blomfield’s statement is as follows.

In 2010 I was adjudged bankrupt on personal guarantees of $3.5 million. I don’t have a lot of excuses. I had too many interrelated companies. We made some poor business decisions. We simply ran out of cash and the whole house of cards crumbled taking me with it. Very humbling, very embarrassing. I have since been discharged from bankruptcy without objection and am slowly rebuilding my commercial life in a far more considered manner.

“I had too many interrelated companies. We made some poor business decisions. We simply ran out of cash”, all interesting turns of phrase, but as always with Blomfield the statements contained in the Standards piece are little more than a complete and utter load of horse shit.

There was no “WE”, (unless Blomfield is including Craig Rolls, his very dodgy lawyers, receivers and co-conspirators). In amongst the spin doctored crap that’s being touted by Blomfields friendly journo’s at New Zealand MSM outlets such as Fairfax and APN, and Blomfield’s own rhetoric, such as that which the Standard published, one simple unassailable truth remains, and yet strangely, its never been investigated or published, by anyone other than Cameron Slater. Blomfield was, and obviously remains, a swindler, a conman, and recidivist bullshit artist.

The fact is, Blomfield never had any cash of his own; he manipulated others, swindled them out of their money, and property; and then used the criminal proceeds in half arsed investments that he never stood a chance of getting across the line.

Blomfield subsequently, single handedly, destroyed the net worth of a number of companies, and lost a whole lot of other peoples money and property; that of both those who had foolishly loaned or advanced Blomfield money, and the victims of Blomfield’s swindling, and the cabals outrageous, duplicitous, and fraudulent, skullduggery.

This is the last article that LF will be posting on the subject of Matthew John Blomfield and his criminal antics until such time as Cameron Slaters High Court appeal (Blomfield v Slater) has been decided. The first call over for that matter has, as far as LF is aware, been set down for Tuesday, February 11th, 2014 in the High Court at Auckland. We will not however be resting. There is a lot more LF has yet to bring readers on this subject.

Bibliography/References

Crawford and Yelcich v Odin Enterprises Limited and others [2009] NZCA 199 (21 May 2009)

Dud Mangawhai development buyers in court

Email thread [Blomfield et al, various dates] (1/542); Subject Mangawhai Developments Limited

Blomfield; draft contract for sale and purchase [PDF] (Dated 2007, see para [34] decision of Woodhouse J, ruling document as being sent 28th September 2007)

Davies & Co Solicitors Nominee Company Limited v Yelcich [2013] NZHC 1344 (6 June 2013)

Davies & Co Solicitors Nominee Company Limited v Yelcich [2013] NZHC 2546 (30 September 2013)

http://www.companymedic.co.nz/profiles.php

http://www.stuff.co.nz/auckland/local-news/north-shore-times/8877087/More-park-space-planned

http://nz.linkedin.com/pub/tom-mansell/15/90b/486

http://www.manselldesign.co.nz/about.html

http://penberthy.co.nz/wawcs0163926/Our-Team.html

http://www.stuff.co.nz/manawatu-standard/features/3534318/Feeling-like-hes-back-home

http://www.stuff.co.nz/sunday-star-times/business/593286

http://www.grownups.co.nz/read/money/trusts_asset_protection/trusts-trouble

No Comments

I hope people like Sharky Robinson are seeing this – he would be just thrilled to see how badly he was defrauded by his old school mate. Friends since about 12 years old and Matt sucks him in, steals from him and leaves him in the shit. What I find also interesting here is Matt has taken money as faux deposits really as he told them they never had to settle – I would expect as with any development funded by banks and or finance companies that a certain level of pre sales would be required to obtain the required funding. I bet the lending institutions on this dud development must now know they were completely defrauded just like Sharky was.

So Blomfield acted as a Real Estate Agent as well – i bet he was / has never been registered. The REAA was formed back then and it was illegal to operate without the required qualifications. Still along with being a fraudster, liar, thief, con man, and prize cunt i guess playing Real Estate Agent was all in a weeks fraud

Just sitting here at my computer with a small glass of 1965 Auchentoshan whiskey, which case was given to me by a well known lowland Scottish businessman. I savour these articles as much as the whiskey, but together they make life worth living, and holidays unnecessary. Well fucking done. Cocksmoker – well Blomfield will be when he’s inside, or some handsome 450 sex offender is inside him. Go you beautiful bastards!!!

Fucking incredible really ! Wow what a scamming prick. How on earth has the SFO not looked at this guy???? His mum must be so proud. Bless her for letting the sperm that created it work it’s magic in her womb

His mum is a drunk. Cameron Slater is New Zealand’s biggest girl, Cameron won’t stand up to ,Matt, Cameron is a baby hoping it will all go away. Cameron Slater what was your motivation to post about Matt? Why have you taken the posts down?